5 Beautiful Women Wizkid Has Dated

The 25-years-old Nigerian superstar Ayodeji Ibrahim Balogun who goes by the stage name of Wizkid is known for releasing hit tracks that gets everyone busting a move or two. He is also known for having an eye for gorgeous and endowed ladies. Today, we look at the gorgeous and beautiful ladies that he has wooed.

Here is a list of the beautiful and endowed women that the Nigerian superstar, Wizkid has dated:

Sophie Rammal

The Nigerian superstar, Wizkid dated the Lebanese beauty, Sophie Rammal during his teenage years but they soon parted ways. She also appeared in the StarBoy CEO’s debut music video titled “Holla At Your Boy”. They share a baby boy together named Boluwatife and recently, Tania got married to Wale Alakija and she is expecting a child with her new husband.

Tania Omotayo

Nigeria’s superstar, Wizkid has been dating his boo of many years, Tania Omotayo but the two recently parted ways. Despite a couple of social media hints and drama that led to the tales, the two managed to keep their relationship away from the media. A rep from Wizkid’s crew told a source that “Tania broke up with Wiz a while ago but both parties agreed to be friendly towards each other”. She kept her distance and missed a lot of his events and performance for example she was absent at Wizkid’s 25th birthday party in SouthAfrica.

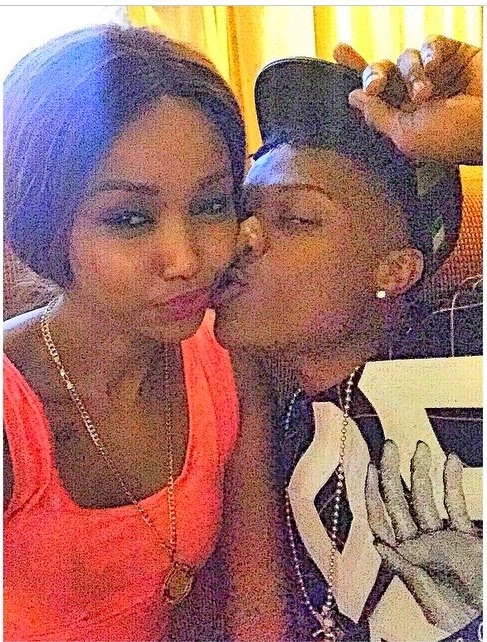

Hudda Monreo

Rumours has it that Wiizkid is having an affair with the former Big Brother Africa contestant, Hudda Monreo. She went on to confirm the rumours by posting cosy pictures of them on instagram.

Tonto Dikeh

It was alleged that the fast rising star, Wizkid had a secret romantic affair with the sultry actress, Tonto Dikeh. She recently replied to rumours by saying: “Wizkid is just a friend on twitter, am not in a relationship with him”. Wizkid replied by saying; “I am single, even though I have a lot of girls around me”.

Chidinma Ekile

The Nigerian superstar, Wizkid confessed that he has a huge celebrity crush on Chidinma Ekile. This is what he said: “ I have a huge crush on Chidinma for a long time… she doesn’t know it but its true”. The two would make a great couple.